The balance sheet is a financial statement that describes what the firm is worth at any one point in time. Balance sheet is more like a snapshot of the financial position of a company at a specified time, usually calculated after every quarter, six months or one year. A typical company balance sheet consists of the three sections; assets, liabilities and owner’s equity or capital.

Often described as a “snapshot of a company’s financial condition”, it is the only financial statement which applies to a single point in time. It is crucial that all potential investors know how to read, use, and analyze this document. The accounts of the balance sheet do not show results, but net values. Balance Sheet is the financial statement of a company which includes assets, liabilities, equity capital, total debt, etc. at a point in time.

How the balance sheet ‘balances’

This report is based on the most basic accounting principle that net worth (shareholder’s/ Owner’s equity) must equal assets minus liabilities.

The statement is divided into two parts, 1) assets and 2) Liabilities & owner’s equity.

The two sides of the balance sheet must equal, which makes sense: a company has to pay for all the things it has (assets) by either borrowing money (liabilities) or getting it from shareholder’s (owner’s equity).

That is, the Balance sheet includes assets on one side, and liabilities on the other. For the balance sheet to reflect the true picture, both heads (liabilities & assets) should tally (Assets = Liabilities + Equity).

Let’s understand each one of them:

Assets: An asset is anything of value (resources or things) that a company owns. This includes cash, property and equipment, inventory, accounts receivables and more. An asset is something that can be converted to cash value.

In the balance sheet, the total value of assets represents an important part of the equation. Assets are an indication of a company’s holdings and contribute to overall value.

Assets can be divided into current as well as non-current assets or long term assets.

Liabilities: A liability is an amount (debts or obligations) that a company owes. Typically, a liability involves money borrowed in order to support business activities, so can also include accounts payable and general debt.

In the balance sheet, the total liabilities is the total money owed, whether to a lender, bank, or supplier. In relation to the assets, it provides an idea of how stable a business is, as well as whether accounts are overdue.

Liabilities are the amount that the company owes to its creditors. Liabilities can be divided into current liabilities and long-term liabilities.

Owner’s Equity: Another important head in the balance sheet is shareholder or owner’s equity. It is the assets minus the liabilities. Any remaining value in assets can be attributed to owner’s equity.

Assets are equal to total liabilities and owners’ equity. Owner’s equity is used when the company is a sole proprietorship and shareholders’ equity is used when the company is a corporation. It is also known as book value of the company.

In any typical balance sheet, the total assets of company should be equal to the total liabilities of the company. Hence,

Assets = Liabilities

The equation above is called the balance sheet equation or the accounting equation. In fact this equation depicts the key property of the balance sheet i.e the balance sheet should always be balanced. In other word the Assets of the company should be equal to the Liabilities of the company. This is because everything that a company owns (Assets) has to be purchased either from either the owner’s capital or liabilities.

Owners Capital is the difference between the Assets and Liabilities. It is also called the ‘Shareholders Equity’ or the ‘Net worth’. Representing this in the form of an equation :

Share holders equity = Assets – Liabilities

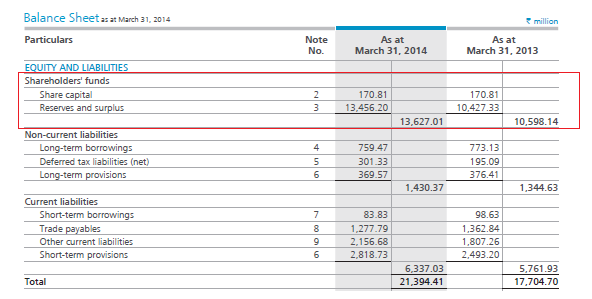

As we know the balance sheet has two main sections i.e. the assets and the liabilities. The liabilities as you know represent the obligation of the company. The shareholders’ fund, which is integral to the liabilities side of the balance sheet, is highlighted in the snapshot below. Many people find this term a little confusing.

If you think about it, on one hand we are discussing about liabilities which represent the obligation of the company, and on the other hand we are discussing the shareholders’ fund which represents the shareholders’ wealth. This is quite counter intuitive isn’t it? How can liabilities and shareholders’ funds appear on the ‘Liabilities’ side of balance sheet? After all the shareholders funds represents the funds belonging to its shareholders’ which in the true sense is an asset and not really a liability.

To make sense of this, you should change the perceptive in which you look at a company’s financial statement. Think about the entire company as an individual, whose sole job is run its core operation and to create wealth to its shareholders’. By thinking this way, you are in fact separating out the shareholders’ (which also includes its promoters) and the company. With this new perspective, now think about the financial statement. You will appreciate that, the financial statements is a statement published by the company (which is an entity on its own) to communicate to the world about its financial well being.

This also means the shareholders’ funds do not belong to the company as it rightfully belongs to the company’s shareholders’. Hence from the company’s perspective the shareholders’ funds are an obligation payable to shareholders’. Hence this is shown on the liabilities side of the balance sheet.

Let’s understand reporting of a transaction on a balance sheet. If a company ABC takes a five-year loan from public sector banks for an amount of Rs 1,00,000, it means that the bank will pay the money to ABC Ltd.

The accounts department will increase the cash component by 1,00,000 on the assets front, and at the same time increase the long-term debt account with the same amount, thus balancing both the sides.

If company raises Rs 10,00,000 from investors, then its assets will increase by that amount, as will its shareholder’s equity.

If company raises Rs 10,00,000 from investors, then its assets will increase by that amount, as will its shareholder’s equity.

The balance sheet, along with the income and cash flow statement, is an important tool for owners but also for investors because it is used to gain insight into a company and its financial operations.

It is important that investors understand how to use, analyse, and read the document.

Why the balance sheet is important

Questions about liquidity and efficiency are two of the more common aspects of a business revealed in the balance sheet.

Liquidity: liquidity is generally more thoroughly measured by applying one or more ratios to produce a percentage that can easily be compared against previous, future, and market percentages. The ratios most commonly used are the current ratio and the quick ratio.

Efficiency: efficiency seems fairly straightforward as it involves how well a business is managing its assets including working capital. This provides a better idea of the financial efficiency on a day-to-day basis for the given time period.

The balance sheet can also provide insight into a business's leverage, which can illustrate the amount of risk being taken, as well as the returns, such as returns on investment (ROI).

Understanding a balance sheet

While it may seem intimidating for those unfamiliar with accounting practices, the balance sheet is easily interpreted, especially for small businesses that have fewer entries as compared to a large corporation, for example.

While one balance sheet on its own only provides information about the period selected, it can be useful to compare it to balance sheets from previous periods as well as calculate ratios mentioned above to compare across these financial periods. In addition, it can be compared with other businesses in order to gain an understanding of how a business stands in a particular industry.

Balance sheet and Debtor

Thankfully, modern invoicing and accounting software makes balancing your assets, liabilities and owner’s equity a bit easier. With Debtor, you can view your balance sheet, which automatically updates when you enter new details, at any given time and select the time frame.

No longer do you need to spend time painstakingly combing through a spreadsheet. The balance sheet gathers and provides the information regarding your accounts. All you need to do is keep them up to date!

No comments:

Post a Comment