The balance sheet equation

While the P&L statement gives us information pertaining to the profitability of the company, the balance sheet gives us information pertaining to the assets, liabilities, and the shareholders equity. The P&L statement as you understood, discusses about the profitability for the financial year under consideration, hence it is good to say that the P&L statement is a standalone statement. The balance sheet however is prepared on a flow basis, meaning, it has financial information pertaining to the company right from the time it was incorporated. Thus while the P&L talks about how the company performed in a particular financial year; the balance sheet on the other hand discusses how the company has evolved financially over the years.

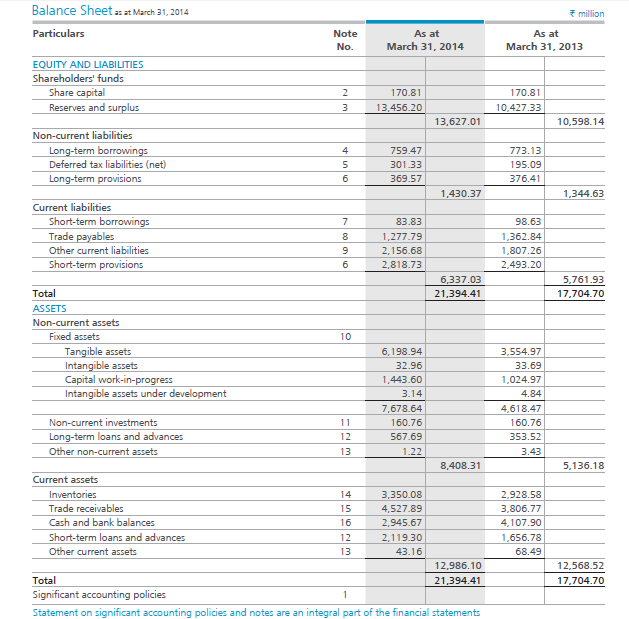

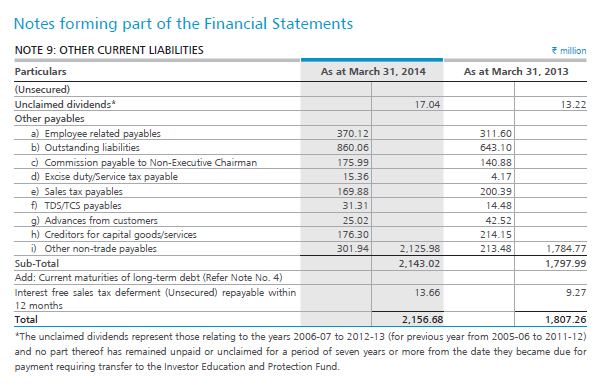

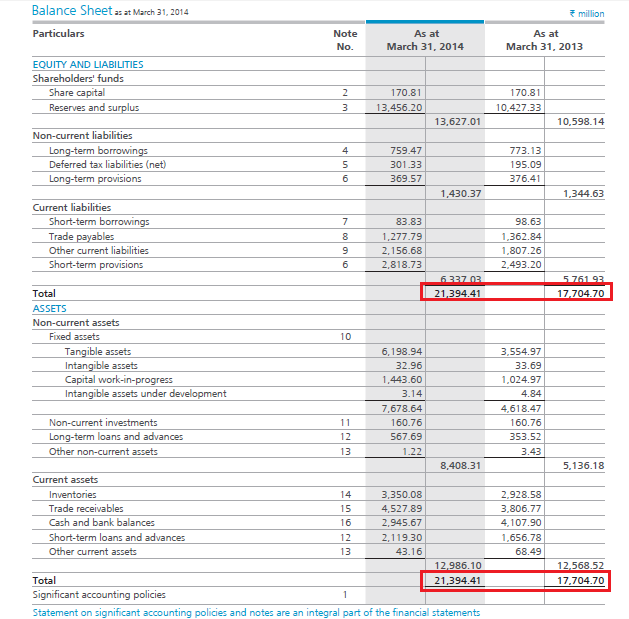

Have a look at the balance sheet of Amara Raja Batteries Limited (ARBL):

As you can see the balance sheet contains details about the assets, liabilities, and equity.

We had discussed about assets in the previous chapter. Assets, both tangible and intangible are owned by the company. An asset is a resource controlled by the company, and is expected to have an economic value in the future. Typical examples of assets include plants, machinery, cash, brands, patents etc. Assets are of two types, current and non-current, we will discuss these later in the chapter.

Liability on the other hand represents the company’s obligation. The obligation is taken up by the company because the company believes these obligations will provide economic value in the long run. Liability in simple words is the loan that the company has taken and it is therefore obligated to repay back. Typical examples of obligation include short term borrowing, long term borrowing, payments due etc. Liabilities are of two types namely current and non-current. We will discuss about the kinds of liabilities later on in the chapter.

In any typical balance sheet, the total assets of company should be equal to the total liabilities of the company. Hence,

Assets = Liabilities

The equation above is called the balance sheet equation or the accounting equation. In fact this equation depicts the key property of the balance sheet i.e the balance sheet should always be balanced. In other word the Assets of the company should be equal to the Liabilities of the company. This is because everything that a company owns (Assets) has to be purchased either from either the owner’s capital or liabilities.

Owners Capital is the difference between the Assets and Liabilities. It is also called the ‘Shareholders Equity’ or the ‘Net worth’. Representing this in the form of an equation :

Share holders equity = Assets – Liabilities

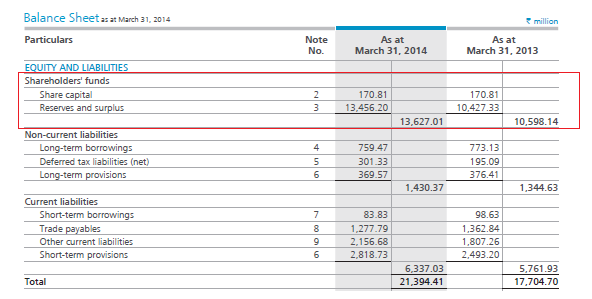

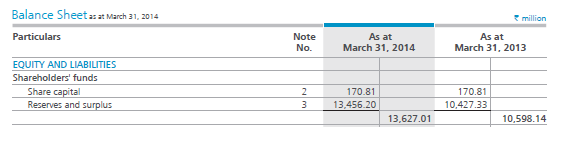

A quick note on shareholders’ funds

As we know the balance sheet has two main sections i.e. the assets and the liabilities. The liabilities as you know represent the obligation of the company. The shareholders’ fund, which is integral to the liabilities side of the balance sheet, is highlighted in the snapshot below. Many people find this term a little confusing.

If you think about it, on one hand we are discussing about liabilities which represent the obligation of the company, and on the other hand we are discussing the shareholders’ fund which represents the shareholders’ wealth. This is quite counter intuitive isn’t it? How can liabilities and shareholders’ funds appear on the ‘Liabilities’ side of balance sheet? After all the shareholders funds represents the funds belonging to its shareholders’ which in the true sense is an asset and not really a liability.

To make sense of this, you should change the perceptive in which you look at a company’s financial statement. Think about the entire company as an individual, whose sole job is run its core operation and to create wealth to its shareholders’. By thinking this way, you are in fact separating out the shareholders’ (which also includes its promoters) and the company. With this new perspective, now think about the financial statement. You will appreciate that, the financial statements is a statement published by the company (which is an entity on its own) to communicate to the world about its financial well being.

This also means the shareholders’ funds do not belong to the company as it rightfully belongs to the company’s shareholders’. Hence from the company’s perspective the shareholders’ funds are an obligation payable to shareholders’. Hence this is shown on the liabilities side of the balance sheet.

The liability side of balance sheet

The liabilities side of the balance sheet details out all the liabilities of the company. Within liabilities there are three sub sections – shareholders’ fund, non-current liabilities, and current liabilities. The first section is the shareholders’ funds.

To understand share capital, think about a fictional company issuing shares for the first time. Imagine, Company ABC issues 1000 shares, with each share having a face value of Rs.10 each. The share capital in this case would be Rs.10 x 1000 = Rs.10,000/- (Face value X number of shares).

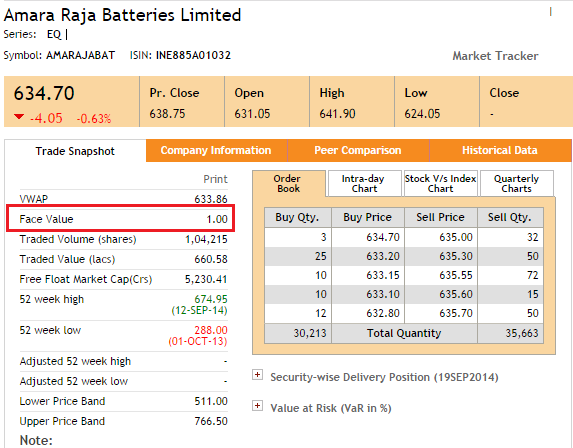

In the case of ARBL, the share capital is Rs.17.081 Crs (as published in the Balance Sheet) and the Face Value is Rs.1/-. I got the FV value from the NSE’s website:

I can use the FV and share capital value to calculate the number of shares outstanding. We know:

Share Capital = FV * Number of shares

Therefore,

Number of shares = Share Capital / FV

Hence in case of ARBL,

Number of shares = 17,08,10,000 / 1

= 17,08,10,000 shares

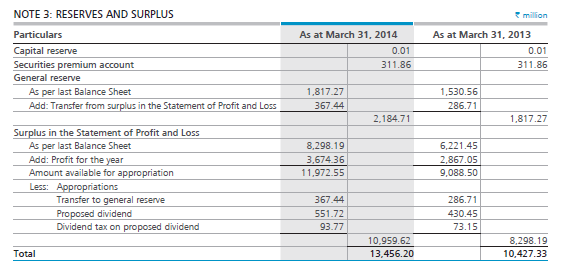

The next line item on the liability side of the Balance Sheet is the ‘Reserves and Surplus’. Reserves are usually money earmarked by the company for specific purposes. Surplus is where all the profits of the company reside. The reserves and surplus for ARBL stands at Rs.1,345.6 Crs. The reserves and surplus have an associated note, numbered 3. Let us look into the same.

As you can notice from the note, the company has earmarked funds across three kinds of reserves:

- Capital reserves – Usually earmarked for long term projects. Clearly ARBL does not have much amount here. This amount belongs to the shareholders, but cannot be distributed to them.

- Securities premium reserve / account – This is where the premium over and above the face/par value of the shares sits. ARBL has a Rs.31.18 Crs under this reserve

- General reserve – This is where all the accumulated profits of the company which is not yet distributed to the shareholder reside. The company can use the money here as a buffer. As you can see ARBL has Rs.218.4 Crs in general reserves.

The next section deals with the surplus. As mentioned earlier, surplus holds the profits made during the year. Couple of interesting things to note:

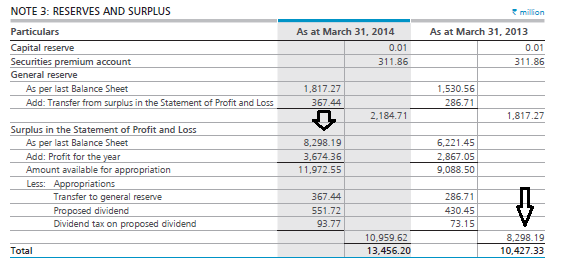

- As per the last year (FY13) balance sheet the surplus was Rs.829.8Crs. This is what is stated as the opening line under surplus. See the image below:

- The current year (FY14) profit of Rs.367.4 Crs is added to previous years closing balance of surplus. Few things to take note here:

- Notice how the bottom line of P&L is interacting with the balance sheet. This highlights a very important fact – all the three financial statements are closely related

- Notice how the previous year balance sheet number is added up to this year’s number. This highlights the fact that the balance sheet is prepared on a flow basis, adding the carrying forward numbers year on year

- Previous year’s balance plus this year’s profit adds up to Rs.1197.2 Crs. The company can choose to apportion this money for various purposes.

- The first thing a company does is it transfers some money from the surplus to general reserves so that it will come handy for future use. They have transferred close to Rs.36.7 Crs for this purpose

- After transferring to general reserves they have distributed Rs.55.1 Crs as dividends over which they have to pay Rs.9.3 Crs as dividend distribution taxes.

- After making the necessary apportions the company has Rs.1095.9 Crs as surplus as closing balance. This as you may have guessed will be the opening balance for next year’s (FY15) surplus account.

- Total Reserves and Surplus = Capital reserve + securities premium reserve + general reserves + surplus for the year. This stands at Rs.1345.6 Crs for the FY 14 against Rs.1042.7 Crs for the FY13

The total shareholders’ fund is a sum of share capital and reserves & surplus. Since this amount on the liability side of the balance sheet represents the money belonging to shareholders’, this is called the ‘shareholders funds’.

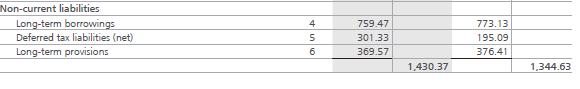

Non Current Liabilities

Non-current liabilities represent the long term obligations, which the company intends to settle/ pay off not within 365 days/ 12 months of the balance sheet date. These obligations stay on the books for few years. Non-current liabilities are generally settled after 12 months after the reporting period.

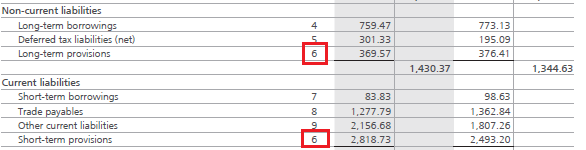

Here is the snapshot of the non-current liabilities of Amara Raja batteries Ltd.

The company has three types of non-current liabilities; let us inspect each one of them.

The long term borrowing (associated with note 4) is the first line item within the non-current liabilities. Long term borrowing is one of the most important line item in the entire balance sheet as it represents the amount of money that the company has borrowed through various sources. Long term borrowing is also one of the key inputs while calculating some of the financial ratios. Subsequently in this module we will look into the financial ratios.

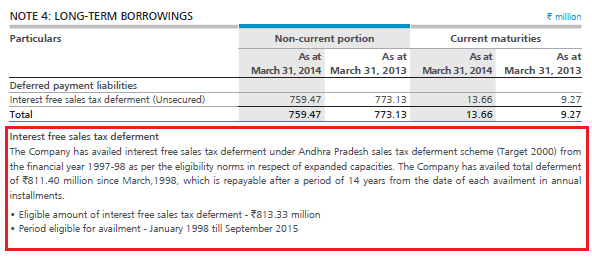

Let us look into the note associated with ‘Long term borrowings’:

From the note it is quite clear that the ‘Long term borrowings’ is in the form of ‘interest free sales tax deferment’. To understand what interest free sales tax deferment really means, the company has explained just below the note (I have highlighted the same in a red box). It appears to be some sort of tax incentive from the state government. The company plans to settle this amount over a period of 14 years.

You will find that there are many companies which do not have long term borrowings (debt). While it is a good to know that the company has no debt, you must also question as to why there is no debt? Is it because the banks are refusing to lend to the company? or is it because the company is not taking initiatives to expand their business operations. Of course, we will deal with the analysis part of the balance sheet later in the module.

Do recollect, we looked at ‘Finance Cost’ as a line item when we looked at the P&L statement. If the debt of the company is high, then the finance cost will also be high.

The next line item within the non-current liability is ‘Deferred Tax Liability’. The deferred tax liability is basically a provision for future tax payments. The company foresees a situation where it may have to pay additional taxes in the future; hence they set aside some funds for this purpose. Why do you think the company would put itself in a situation where it has to pay more taxes for the current year at some point in the future?

Well this happens because of the difference in the way depreciation is treated as per Company’s act and Income tax. We will not get into this aspect as we will digress from our objective of becoming users of financial statements. But do remember, deferred tax liability arises due to the treatment of depreciation.

The last line item within the non-current liability is the ‘Long term provisions’. Long term provisions are usually money set aside for employee benefits such as gratuity; leave encashment, provident funds etc.

Current liabilities

Current liabilities are a company’s obligations which are expected to be settled within 365 days (less than 1 year). The term ‘Current’ is used to indicate that the obligation is going to be settled soon, within a year. Going by that ‘non-current’ clearly means obligations that extend beyond 365 days.

Think about this way – if you buy a mobile phone on EMI (via a credit card) you obviously plan to repay your credit card company within a few months. This becomes your ‘current liability’. However if you buy an apartment by seeking a 15 year home loan from a housing finance company, it becomes your ‘non-current liability’.

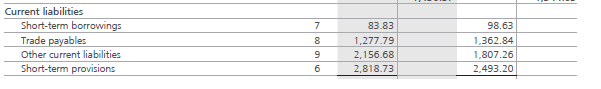

Here is the snapshot of ARBL’s current liabilities:

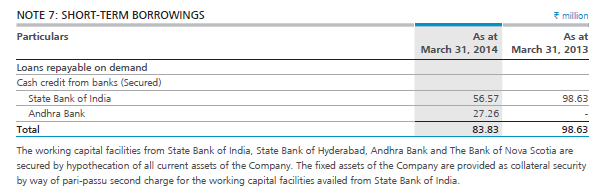

As you can see there are 4 line items within the current liabilities. The first one is the short term borrowings. As the name suggests, these are short term obligations of the company usually undertaken by the company to meet day to day cash requirements (also called working capital requirements). Here is the extract of note 7, which details what short term borrowings mean:

Clearly as you can see, these are short term loans availed from the State bank of India and Andhra Bank towards meeting the working capital requirements. It is interesting to note that the short term borrowing is also kept at low level, at just Rs.8.3Crs.

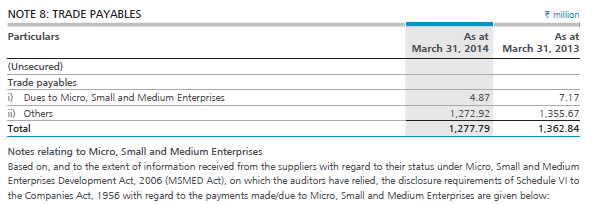

The next line item is Trade Payable (also called account payable) which is at Rs.127.7 Crs. These are obligations payable to vendors who supply to the company. The vendors could be raw material suppliers, utility companies providing services, stationary companies etc. Have a look at note 8 which gives the details:

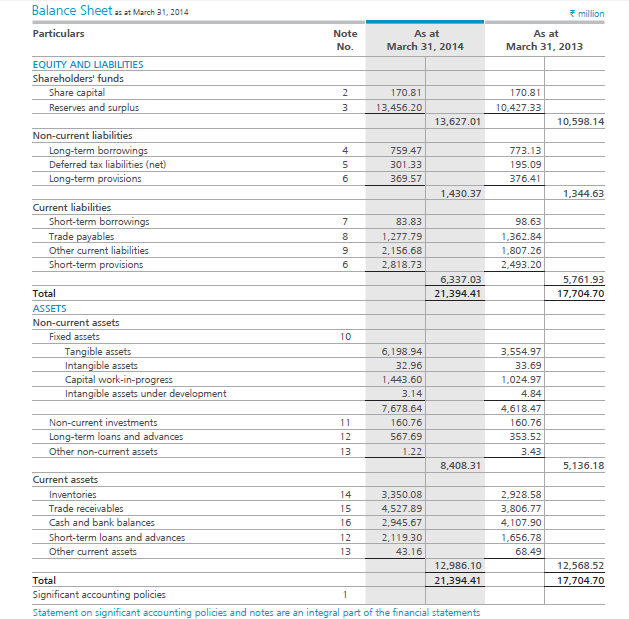

The next line item just says ‘Other current liabilities’ which stands at Rs.215.6 Crs. Usually ‘Other current Liabilities’ are obligations associated with the statutory requirements and obligations that are not directly related to the operations of the company. Here is note 9 associated with ‘Other current liabilities’:

The last line item in current liabilities is the ‘Short term provisions’ which stands at Rs.281.8 Crs. Short term provisions is quite similar to long term provisions, both of which deals with setting aside funds for employee benefits such as gratuity, leave encashment, provident funds etc. Interestingly the note associated with ‘Short term Provisions’ and the ‘Long term provisions’ is the same. Have a look at the following:

Since note 6 is detailing both long and short term provisions it runs into several pages, hence for this reason I will not represent an extract of it. For those who are curious to look into the same can refer to pages 80, 81, 82 and 83 in the FY14 Annual report for Amara Raja Batteries Limited.

However, from the user of a financial statement perspective all you need to know is that these line items (short and long term provisions) deal with the employee and related benefits. Please note, one should always look at the associated note to run through the details.

We have now looked through half of the balance sheet which is broadly classified as the Liabilities side of the Balance sheet. Let us relook at the balance sheet once again to get a perspective:

Clearly,

Total Liability = Shareholders’ Funds + Non Current Liabilities + Current Liabilities

= 1362.7 + 143.03 + 633.7

Total Liability = Rs.2139.4 Crs

The Assets side of Balance Sheet

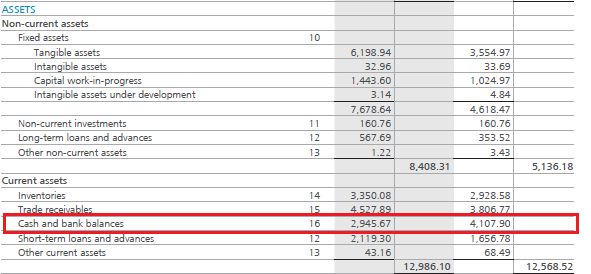

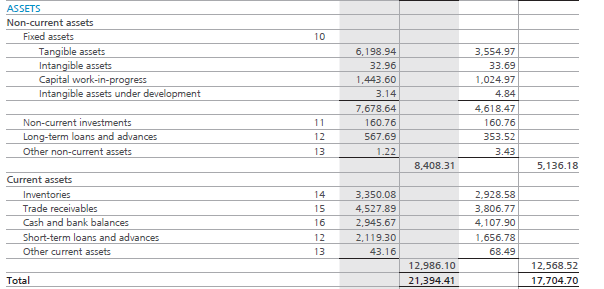

In the previous chapter we looked at the liability side of the balance sheet in detail. We will now proceed to understand the 2nd half of the balance sheet i.e the Asset side of the balance sheet. The Asset side shows us all the assets the company owns (in different forms) right from its inception. Assets in simple terms are the resources held by a company, which help in generating the revenues. Here is the snapshot of the Assets side of the balance sheet:

As you can see the Asset side has two main sections i.e Non-current assets and Current assets. Both these sections have several line items (with associated notes) included within. We will look into each one of these line items.

Non-current assets (Fixed Assets)

Similar to what we learnt in the previous chapter, non-current assets talks about the assets that the company owns, the economic benefit of which is enjoyed over a long period (beyond 365 days). Remember an asset owned by a company is expected to give the company an economic benefit over its useful life.

If you notice within the non-current assets there is a subsection called “Fixed Assets” with many line items under it. Fixed assets are assets (both tangible and intangible) that the company owns which cannot be converted to cash easily or which cannot be liquidated easily. Typical examples of fixed assets are land, plant and machinery, vehicles, building etc. Intangible assets are also considered fixed assets because they benefit companies over a long period of time. If you see, all the line items within fixed assets have a common note, numbered 10, which we will explore in great detail shortly.

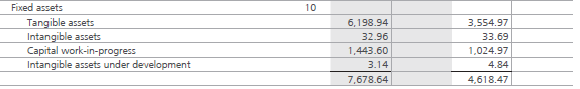

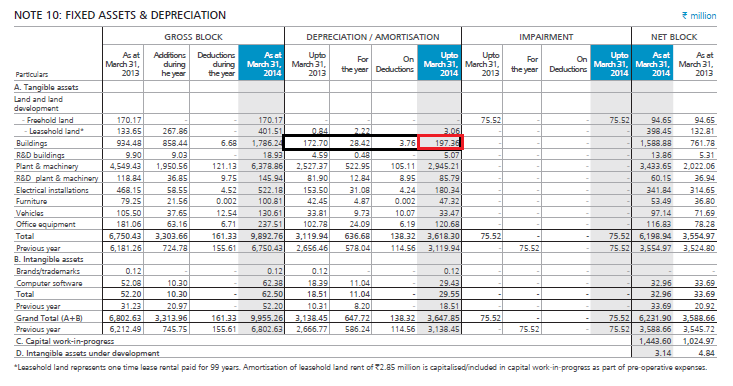

Here is the snapshot of fixed assets of Amara Raja Batteries Limited:

The first line item ‘Tangible Assets’ is valued at Rs.619.8Crs. Tangible assets consists of assets which has a physical form. In other words these assets can be seen or touched. This usually includes plant and machinery, vehicles, buildings, fixtures etc.

Likewise the next line item reports the value of Intangible assets valued at Rs.3.2 Crs. Intangible assets are assets which have an economic value, but do not have a physical nature. This usually includes patents, copyrights, trademarks, designs etc.

Remember when we discussed the P&L statement we discussed depreciation. Depreciation is a way of spreading the cost of acquiring the asset over its useful life. The value of the assets deplete over time, as the assets lose their productive capacity due to obsolescence and physical wear and tear. This value is called the Depreciation expense, which is shown in the Profit and Loss account and the Balance Sheet.

All the assets should be depreciated over its useful life. Keeping this in perspective, when the company acquires an asset it is called the ‘Gross Block’. Depreciation should be deducted from the Gross block, after which we can arrive at the ‘Net Block’.

Net Block = Gross Block –Accumulated Depreciation

Note, the term ‘Accumulated’ is used to indicate all the depreciation value since the incorporation of the company.

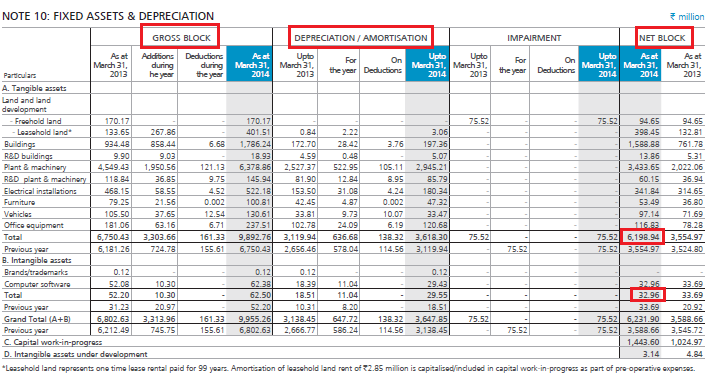

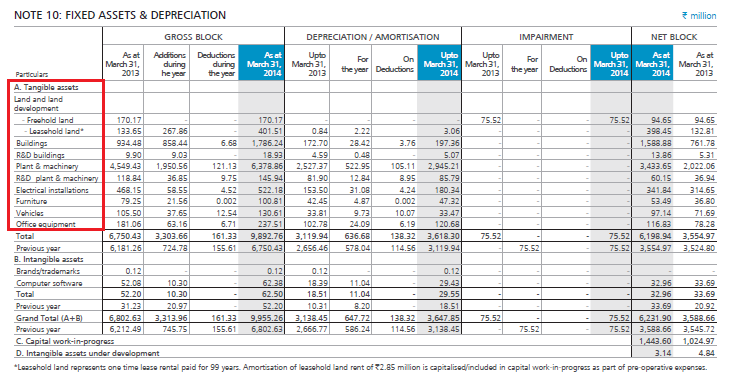

When we read tangible assets at Rs.619.8 Crs and Intangible assets at Rs.3.2 Crs, do remember the company is reporting its Net block, which is Net of Accumulated depreciation. Have a look at the Note 10, which is associated with fixed assets.

At the top of the note you can see the Gross Block, Depreciation/amortization, and Net block being highlighted. I have also highlighted two net block numbers which tallies with what was mentioned in the balance sheet.

Let us look at a few more interesting aspects on this note. Notice under Tangible assets you can see the list of all the assets the company owns.

For example, the company has listed ‘Buildings’ as one of its tangible asset. I have highlighted this part:-

As of 31st March 2013 (FY13) ARBL reported the value of the building at Rs.93.4 Crs. During the FY14 the company added Rs.85.8Crs worth of building, this amount is classified as ‘additions during the year’. Further they also wound up 0.668 Crs worth of building; this amount is classified as ‘deductions during the year’. Hence the current year value of the building would be:

Previous year’s value of building + addition during this year – deduction during the year

93.4 + 85.8 – 0.668

= 178.5Crs

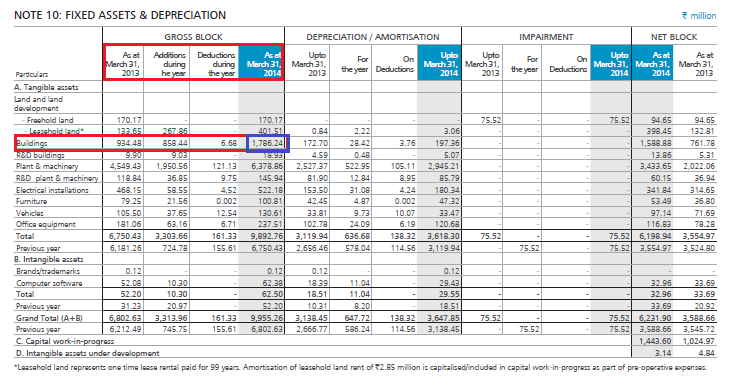

You can notice this number being highlighted in blue in the above image. Do remember this is the gross block of the building. From the gross block one needs to deduct the accumulated depreciation to arrive at the ‘Net Block’. In the snapshot below, I have highlighted the depreciation section belonging to the ‘Building’.

As of 31st March 2013 (FY13) ARBL has depreciated Rs.17.2 Crs, to which they need to add Rs.2.8 Crs belonging to the year FY14, adjust 0.376 Crs as the deduction for the year. Thus, the Total Depreciation for the year is:-

Previous year’s depreciation value + Current year’s depreciation – Deduction for the year

= 17.2 + 2.8 – 0.376

Total Depreciation= Rs.19.736 Crs. This is highlighted in red in the image above.

So, we have building gross block at Rs.178.6 Crs and depreciation at Rs.19.73 Crs which gives us a net block of Rs.158.8 Crs ( 178.6– 19.73). The same has been highlighted in the image below:

The same exercise is carried out for all the other tangible and intangible assets to arrive at the Total Net block number.

The next two line items under the fixed assets are Capital work in progress (CWIP) and Intangible assets under development.

CWIP includes building under construction, machinery under assembly etc at the time of preparing the balance sheet. Hence it is aptly called the “Capital Work in Progress”. This amount is usually mentioned in the Net block section. CWIP is the work that is not yet complete but where a capital expenditure has already been incurred. As we can see, ARBL has Rs.144.3 Crs under CWIP. Once the construction process is done and the asset is put to use, the asset is moved to tangible assets (under fixed assets) from CWIP.

The last line item is ‘Intangible assets under development’. This is similar to CWIP but for intangible assets. The work in process could be patent filing, copyright filing, brand development etc. This is at a miniscule cost of 0.3 Crs for ARBL. All these costs are added to arrive at the total fixed cost of the company.

Non-current assets (Other line items)

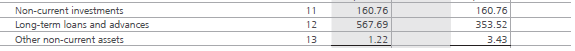

Besides the fixed assets under the non-current assets, there are other line items as well. Here is a snapshot for the same:

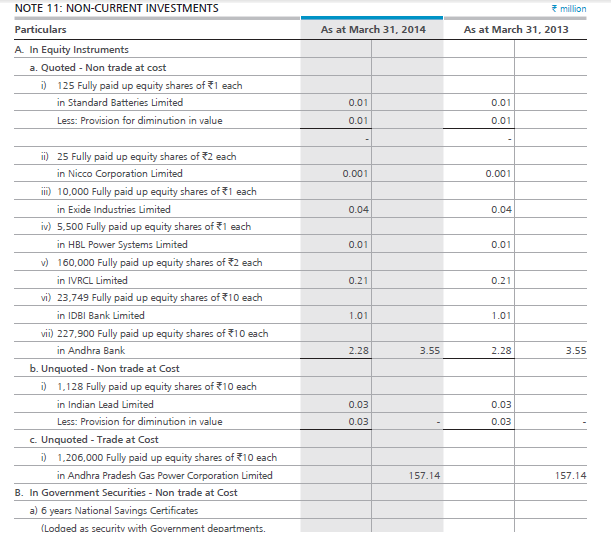

Non-current investments are investments made by ARBL with a long term perspective. This stands at Rs.16.07 Crs. The investment could be anything – buying listed equity shares, minority stake in other companies, debentures, mutual funds etc. Here is the partial (as I could not fit the entire image) snapshot of Note 11. This should give you a perspective.

The next line item is long term loans and advances which stand at Rs.56.7Crs. These are loans and advances given out by the company to other group companies, employees, suppliers, vendors etc.

The last line item under the Non-current assets is ‘Other Non-current assets’ which is at Rs. 0.122 Crs. This includes other miscellaneous long term assets.

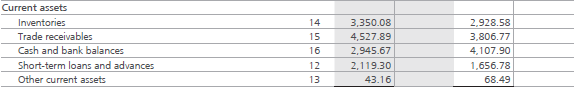

Current assets

Current assets are assets that can be easily converted to cash and the company foresees a situation of consuming these assets within 365 days. Current assets are the assets that a company uses to fund its day to day operations and ongoing expenses.

The most common current assets are cash and cash equivalents, inventories, receivables, short term loans and advances and sundry debtors.

Here is the snapshot of the current assets of ARBL:

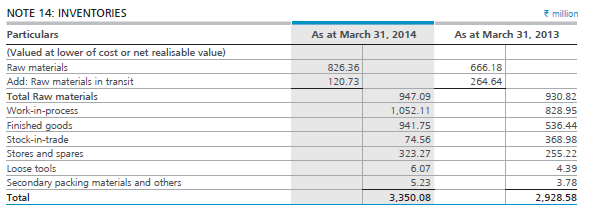

The first line item on the Current assets is Inventory which stands at Rs.335.0 Crs. Inventory includes all the finished goods manufactured by the company, raw materials in stock, goods that are manufactured incompletely etc. Inventories are goods at various stages of production and hence have not been sold. When any product is manufactured in a company it goes through various processes from raw material, to work in progress to a finished good. Snapshot of Note 14 associated with inventory of the company is as shown below:

As you can see, a bulk of the inventory value comes from ‘Raw material’ and ‘Work-in- progress’.

The next line item is ‘Trade Receivables’ also referred to as ‘Accounts Receivables’. This represents the amount of money that the company is expected to receive from its distributors, customers and other related parties. The trade receivable for ARBL stands at Rs.452.7 Crs.

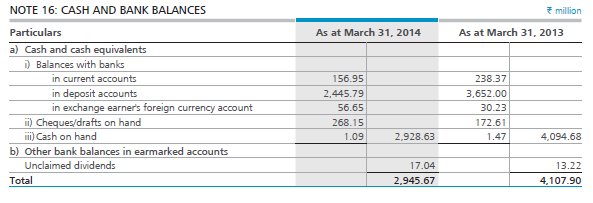

The next line item is the Cash and Cash equivalents, which are considered the most liquid assets found in the Balance sheet of any company. Cash comprises of cash on hand and cash on demand. Cash equivalents are short term, highly liquid investments which has a maturity date of less than three months from its acquisition date. This stands at Rs.294.5 Crs. Note 16 associated with Cash and bank balances is as shown below. As you can see the company has cash parked in various types of accounts.

The next line item is short-term loans and advances, that the company has tendered and which is expected to be repaid back to the company within 365 days. It includes various items such as advances to suppliers, loans to customers, loans to employees, advance tax payments (income tax, wealth tax) etc. This stands at Rs.211.9 Crs. Following this, is the last line item on the Assets side and infact on the Balance sheet itself. This is the ‘Other current assets’ which are not considered important, hence termed ‘Other’. This stands at Rs.4.3 Crs.

To sum up, the Total Assets of the company would now be:-

Fixed Assets + Current Assets

= Rs.840.831 Crs + Rs.1298.61 Crs

= Rs. 2139.441 Crs, which is exactly equal to the liabilities of the company.

With this we have now run through the entire Assets side of the Balance sheet, and infact the whole of Balance sheet itself. Let us relook at the balance sheet in its entirety:

As you can see in the above, the balance sheet equation holds true for ARBL’s balance sheet,

Asset = Shareholders’ Funds + Liabilities

Do remember, over the last few chapters we have only inspected the balance sheet and the P&L statements. However, we have not analyzed the data to infer if the numbers are good or bad. We will do the same when we look into the financial ratio analysis chapter.

In the next chapter, we will look into the last financial statement which is the cash flow statement. However, before we conclude this chapter we must look into the many ways the Balance sheet and the P&L statement are interconnected.

Connecting the P&L and Balance Sheet

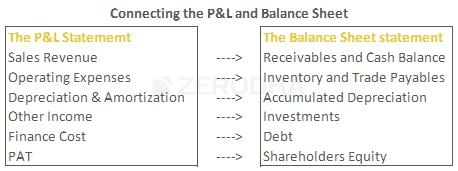

Let us now focus on the Balance Sheet and the P&L statement and the multiple ways they are connected (or affect) to each other.

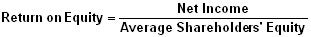

Have a look at the following image:

In the image above, on the left hand side we have the line items on a typical standard P&L statement. Corresponding to that on the right hand side we have some of the standard Balance Sheet items. From the previous chapters, you already know what each of these line items mean. However, we will now understand how the line items in the P&L and the Balance Sheet are connected to each other.

To begin with, consider the Revenue from Sales. When a company makes a sale it incurs expenses. For example if the company undertakes an advertisement campaign to spread awareness about its products, then naturally the company has to spend cash on the campaign. The money spent tends to decrease the cash balance. Also, if the company makes a sale on credit, the Receivables (Accounts Receivables) go higher.

Operating expenses includes purchase of raw material, finished goods and other similar expenses. When a company incurs these expenses, to manufacture goods two things happen. One, if the purchase is on credit (which invariably is) then the Trade payables (accounts payable) go higher. Two, the Inventory level also gets affected. Whether the inventory value is high or low, depends on how much time the company needs to sell its products.

When companies purchase Tangible assets or invest in Brand building exercises (Intangible assets) the company spreads the purchase value of the asset over the economic useful life of the asset. This tends to increase the depreciationmentioned in the Balance sheet. Do remember the Balance sheet is prepared on a flow basis, hence the Depreciation in balance sheet is accumulated year on year. Please note, Depreciation in Balance sheet is referred to as the Accumulated depreciation.

Other income includes monies received in the form of interest income, sale of subsidiary companies, rental income etc. Hence, when companies undertake investment activities, the other incomes tend to get affected.

As and when the company undertakes Debt (it could be short term or long term), the company obviously spends money towards financing the debt. The money that goes towards financing the debt is called the Finance Cost/Borrowing Cost. Hence, when debt increases the finance cost also increases and vice versa.

Finally, as you may recall the Profit after tax (PAT) adds to the surplus of the company which is a part of the Shareholders equity.