Buffett , according to his letter to shareholders, “only” provided around 20% return on average, compounded, per year.

20% does not sound much. But when compounded over 60 years, it brought him from a few million dollars to top 3 richest person on the planet.

Mostly this is because when you invest in stock, you don’t pay capital gain tax until the year you sell the stock. So if you never sell it, you never have to pay tax on it.

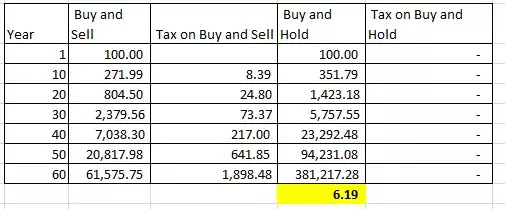

Let’s assume someone buys and sell every year a company that increase in value by 15% a year. Assume Capital Gain tax is 30% for short term investment and 20% for long term investment.

Here is the difference between the two’s wealth after 60 years:

Even if Buffett still have to pay 20% tax on his 6.19 times greater wealth after 60 years, he is still 5 times richer than buy and sell investor.

20% does not sound much. But when compounded over 60 years, it brought him from a few million dollars to top 3 richest person on the planet.

Mostly this is because when you invest in stock, you don’t pay capital gain tax until the year you sell the stock. So if you never sell it, you never have to pay tax on it.

Let’s assume someone buys and sell every year a company that increase in value by 15% a year. Assume Capital Gain tax is 30% for short term investment and 20% for long term investment.

Here is the difference between the two’s wealth after 60 years:

Even if Buffett still have to pay 20% tax on his 6.19 times greater wealth after 60 years, he is still 5 times richer than buy and sell investor.

So the key to minimize your tax and maximize your compounding is finding great companies that grow in very long term, then never selling it for quick short term profit.